10 Federal Programs That Failed Miserably

7. The Internal Revenue Service

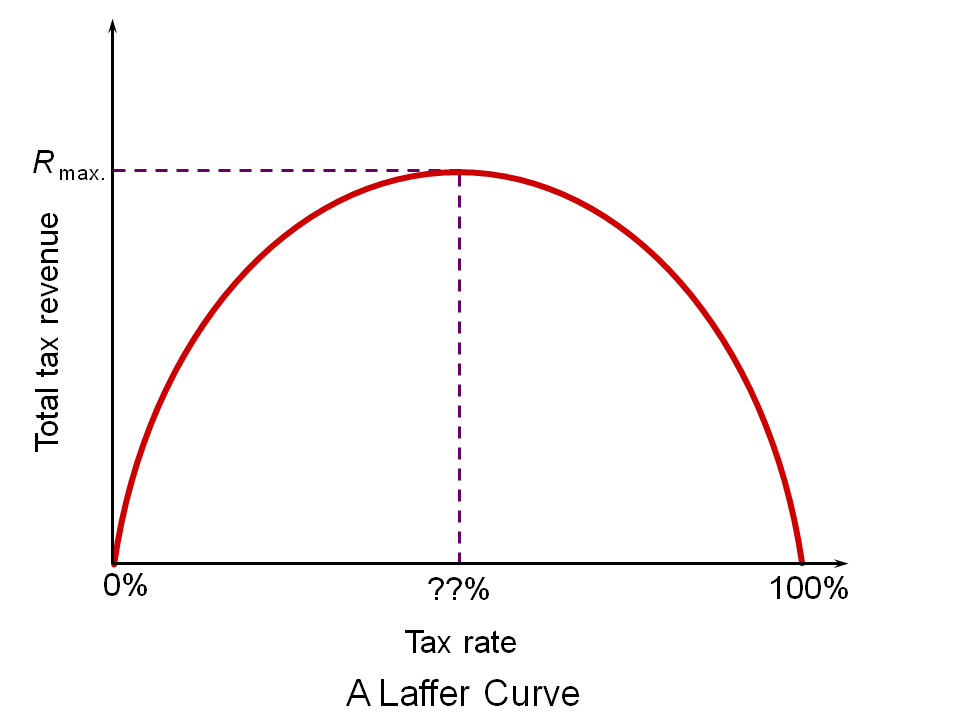

Less a failure than a bureaucratic menace, The Internal Revenue Service traces its roots to 1862 when President Abraham Lincoln signed The Revenue Act of 1862. Instituted to pay for the Civil War, it reached a rate of 10% payable by citizens earning $10,000 or more. The act was allowed to “expire” in 1872, and Americans lived with no federal tax burden until 1913. The 16th Amendment to the United States Constitution allowed congress to “lay and collect taxes on incomes.” Interesting to note the three states that rejected the amendment: Connecticut, Pennsylvania and Utah. The Service created a backlog almost immediately with a two year pile of unprocessed returns by 1919. By 2015, the Internal Revenue Service has become a seriously weaponized bureaucracy with an annual budget deficit of more than $11.5 billion.