10 Reasons to Keep Government Out of Healthcare

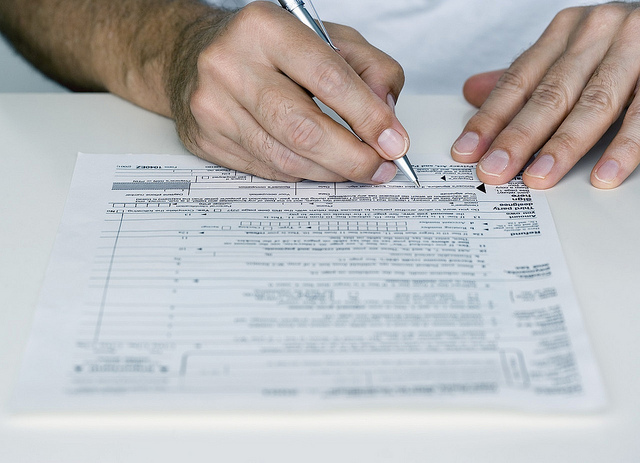

1. Your taxes will go up drastically

We often hear about Scandinavian countries as some kind of a model of health care distribution. Let’s look at the example of Norway. The average Norwegian household pays roughly $70,000 per year in tax. The vast majority of taxes go toward financing the country’s health care. Yes, they get free healthcare and pretty fountains, but for $70,000 per year? The value they get for what they pay is pitiful. You could pay privately for the most expensive health plans in the world and still have tens of thousands of dollars in walking around money. Not to mention, taxes have really driven up the cost of living. It is no coincidence that Norway is simultaneously the most heavily taxed AND most expensive country in the world. Because of this, Norwegians have limited after-tax discretionary spending cash. Sure they have ‘free’ healthcare, but when dinner for two costs an arm and a leg, people scale back their activities.