10 Steps to Fix the US Budget

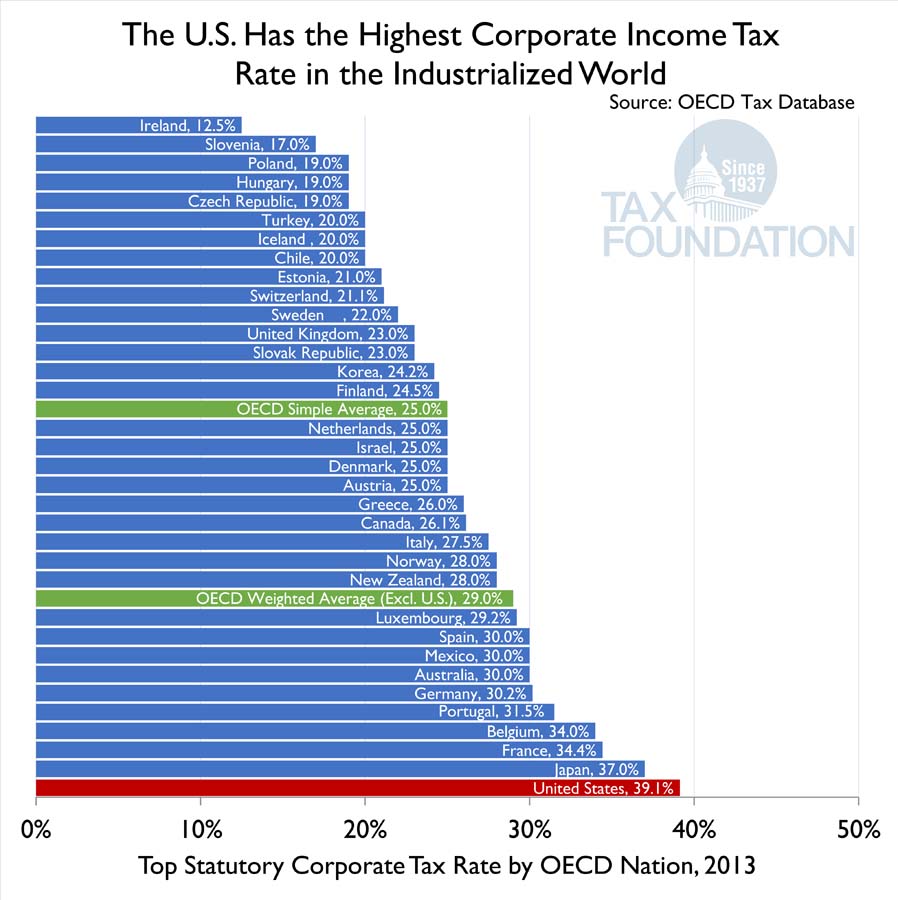

7. Slash the Corporate Tax Rate

The US has the highest corporate tax rate in the industrialized world. Of course, this has led to a high rate of tax inversion—when a company moves it headquarters to a foreign country to save money on taxes. The US corporate tax rate is just under 40%, whereas countries like Great Britain and Switzerland are at 23% and 21%, respectfully. If the US wants companies to stay (and possibly even foreign companies to locate here) it needs to have a competitive corporate tax rate. The US is expected to lose more than $20 Billion this year on tax inversion.

Annual Savings to US Taxpayers: Currently the US is hemorrhaging potential tax revenue. A corporate tax rate that was competitive with the rest of the industrialized world would prevent those losses, plus attract new businesses leading to more revenue. Hundreds of billions could be made in revenue as more business relocate to the US, bringing more jobs with them, as well.

8. Slash the IRS

The Internal Revenue Service has drawn lots of attention for its role in targeting political opposition of President Obama and subsequently losing emails which may have provided evidence of a larger scandal. It is further evidence that the agency has outgrown its intended function and has become a rogue agency with too much power. IRS enforcement should be handled by the FBI or state police forces, they do not need their own SWAT team. Also, since we have cut so much from the bloated budget, already, they really won’t be needing much of its staff. Slashing about half of the agencies budget should provide them with enough to function efficiently and not enough to play politics with.

Annual Savings to US Taxpayers: $5 Billion